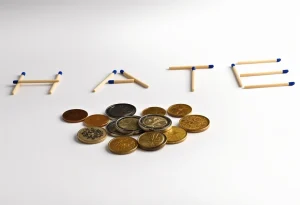

Why Global Tariffs Are About to Change Everything for the U.S. Economy

As global tariffs reshape international trade dynamics, they are poised to have significant impacts on the U.S. economy. Understanding these changes is crucial for stakeholders as they navigate new economic realities and seize opportunities amidst the evolving landscape.

Current Impact of Global Tariffs on Trade Flows

The recent imposition of tariffs has already altered trade flows significantly. As countries increase tariffs, businesses must adapt quickly to these changes. For instance, new tariffs implemented by the U.S. have impacted various sectors, particularly manufacturing and agriculture. According to industry reports, some industries are facing higher input costs, which could lead to price increases for consumers.

Industries Most Affected

Industries such as steel and aluminum production have experienced direct effects from global tariffs, resulting in reallocations across supply chains. This trade repositioning often causes domestic producers to seek less costly resources or shift production locations entirely. Moreover, the agricultural sector is witnessing shifts in exports to markets that were not previously explored, demonstrating the need for flexibility. Importantly, international trade balances are also affected, leading to an increase in the cost of goods overall.

The U.S. Economy Faces New Challenges Ahead

The shifting landscape of tariffs has exposed vulnerabilities within the U.S. economy. Economic experts warn that certain sectors might face downturns as tariffs tighten their grip on imports. During these turbulent times, changes in consumer behavior highlight how economic policies are intertwined with everyday decisions. People are increasingly opting for locally sourced products to mitigate the impact of rising prices tied to imported goods.

As tariffs impose additional costs on businesses, many are passing these expenses onto consumers. This reaction can create a cyclical effect, where diminished purchasing power leads to further economic stress. Consequently, it’s essential for stakeholders to remain vigilant about these patterns and build resilient strategies.

Global Tariffs and the U.S. Economic Policy Landscape

U.S. economic policies surrounding tariffs are evolving rapidly. Recent administrations have proposed a mix of support and restriction on certain tariffs. For instance, policies aimed at deterring unfair trade practices are becoming more common, as seen in the robust push against countries that engage in currency manipulation. According to recent analyses, these policy shifts can reshape how U.S. businesses operate under international pressure.

Governmental Decisions Shaping Tariff Impacts

Government decisions play a crucial role in shaping tariff impacts. By adjusting economic policies, authorities can facilitate or hinder trade prospects. Case studies of specific policy adjustments illustrate how sudden changes can create ripples across the economy, affecting everything from import prices to domestic job markets.

The Crypto Impact: Tariffs and Digital Trade

As traditional trade barriers rise, the cryptocurrency market is starting to feel the pressure of these tariffs as well. The intersection of global tariffs and digital currencies showcases how trade practices can influence emerging financial landscapes. Regulatory bodies are beginning to scrutinize the cryptocurrency market in light of tariffs, considering how these digital currencies can coexist within an increasingly controlled trade environment.

Regulation of Digital Currencies and Trade Tariffs

Blockchain technology may provide solutions that traditional financial systems struggle with. As more businesses face higher costs associated with tariffs, many are investigating blockchain’s potential to create more transparent and efficient payment mechanisms. By doing so, they can hedge against the fluctuating costs caused by tariffs while exploring new avenues for digital trade.

Strategic Responses from U.S. Businesses

In the face of mounting challenges due to global tariffs, U.S. businesses are adopting various strategic responses. Innovations tailored to mitigate tariff costs are becoming increasingly prevalent. For example, some companies are diversifying their supply chains to include a mix of domestic and international resources. This hybrid approach may help these businesses buffer against volatility in trade costs.

Opportunities for Innovation

The shifting tariff landscape presents opportunities for U.S. companies to innovate. Businesses that can pivot quickly to enhance efficiency or develop new products may thrive in this uncertain environment. Success stories of organizations navigating these trade challenges effectively showcase the resilience of American enterprise.

Preparing for Future Economic Trends

Stakeholders should take key insights from the current tariff climate into consideration. Monitoring economic policy shifts will be vital in adapting to changes that could impact operational costs. Companies must also prepare contingency plans to adjust to any potential disruptions stemming from new tariffs.

Actionable Steps for Individuals and Businesses

Individuals are encouraged to diversify their investments and explore local products to evade the impacts of rising costs. Meanwhile, businesses that engage in heightened market analysis can streamline operations effectively to ensure they remain competitive amid evolving economic policies.

Global Tariffs and Their Long-Term Implications

Looking ahead, global tariffs are likely to redefine the U.S. market’s role in international trade. If current trajectories continue, the implications could be profound. Domestic businesses will need to anticipate changes, adapting their strategies for long-term sustainability and growth.

Importance of Foresight in Strategy Adaptation

Foresight in economic strategies is crucial. As stakeholders understand the long-term implications of tariffs, they can make informed decisions that safeguard their interests. The path forward involves not just understanding the present but also predicting future shifts that impact trade and economic health.