Why Stablecoins Are About to Change Everything in U.S. Dollar Stability

Stablecoins represent a significant shift in how we think about currency stability, particularly in relation to the U.S. Dollar. As the crypto economy evolves, understanding their impact on financial stability and economic growth is crucial for stakeholders right now.

The Importance of Stablecoins in Today’s Economy

Stablecoins are emerging as essential tools in today’s economy, particularly for individuals and businesses navigating market volatility. Unlike traditional cryptocurrencies, which can fluctuate wildly, stablecoins average a fixed price, typically pegged to a fiat currency like the U.S. dollar. This feature allows them to serve as a reliable store of value, which is crucial during uncertain financial times.

According to recent analysis, stablecoins offer a crucial bridge between traditional finance and the crypto economy. This bridge facilitates easier acceptance of digital currencies, driving broader financial inclusion and offering a lifeline for individuals in countries facing hyperinflation. Moreover, as these digital tokens are often backed by central bank reserves, their stability significantly influences broader economic stability, promoting investor confidence and economic growth.

Current Challenges Facing the U.S. Dollar

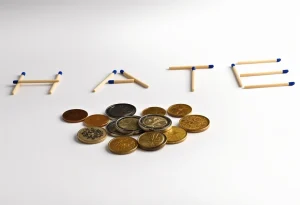

The U.S. Dollar faces significant challenges that impact its stability. Inflationary pressures have been rising, eroding the dollar’s purchasing power and increasing costs for everyday goods. A growing body of evidence suggests that global reserve currencies are shifting, with alternative currencies gaining prominence, which impacts the dollar’s historic dominance.

Additionally, the rapid rise of digital transactions has spotlighted vulnerabilities in the dollar’s infrastructure. Cybersecurity gaps and a lack of regulatory frameworks for digital currencies pose challenges to maintaining the dollar’s integrity. Therefore, understanding how stablecoins fit into this evolving landscape is paramount for financial stability.

How Stablecoins Enhance Financial Stability

Stablecoins can enhance financial stability by reducing market volatility and facilitating secure transactions. Many stablecoins derive their value from being pegged to the U.S. dollar, which allows them to provide a trustworthy alternative in the crypto market. By offering a stable medium of exchange, stablecoins encourage transactions that might otherwise be postponed due to market fluctuations.

Regulations also play a pivotal role in stablecoin operations. Regulatory frameworks can help ensure transparency and security, further solidifying consumer trust. In light of existing vulnerabilities, as suggested by industry experts, regulations could foster an environment conducive to the growth of stablecoins, thereby reinforcing the economic fabric that supports the U.S. Dollar.

Innovations Driving the Stablecoin Market

Technological innovations are driving the rapid adoption of stablecoins. Blockchain technology has enhanced the transparency and security of stablecoin transactions, allowing faster and cheaper cross-border payments. As more players enter the market, including central banks exploring digital currencies, competition is set to reshape the financial landscape.

Successful implementations of stablecoins, such as those used for remittances or cross-border trade, demonstrate their potential to revolutionize various sectors. Many businesses are beginning to adopt stablecoins to reduce transaction costs and enhance efficiency, showcasing the competitive advantage they offer over traditional financial instruments.

Implications for Economic Growth in the Crypto Economy

Stablecoins can unlock new pathways for economic growth within the crypto economy. Their potential to drive financial inclusion cannot be overstated; they allow unbanked and underbanked populations to access financial services, significantly impacting global trade patterns.

Furthermore, stablecoins facilitate cross-border trade by providing a reliable currency alternative when converting local currencies into U.S. dollars or vice versa. This function has implications for traditional banking services, as customers may prefer to transact through stablecoins due to reduced fees and increased efficiency. Consequently, monetary policies may also adapt, reflecting the growing significance of stablecoins in the broader financial ecosystem.

Steps for Engagement with Stablecoins

To fully leverage the benefits of stablecoins, businesses must consider integrating these digital assets into their operations. This integration can streamline transaction processes, reduce costs, and enhance overall efficiency. Additionally, individuals can strategically use stablecoins for personal finance, providing a safe and stable way to hold value.

Staying updated on evolving regulations is crucial. Engaging with resources that monitor the regulatory landscape and market trends can help both businesses and individuals navigate this rapidly changing environment. As regulations unfold, the impact of stablecoins on the U.S. dollar and overall financial stability should not be underestimated.